The mineral processing industry is undergoing a profound transformation, driven by the escalating demand for critical minerals and the unyielding pressure to decarbonize. As of October 2025, global demand for metals like copper, lithium, and nickel—essential for the energy transition—has surged by over 30% year-on-year, according to the International Energy Agency (IEA). Yet, this boom comes at a steep environmental cost: mining accounts for 2-4% of global electricity consumption, with grinding operations alone consuming 30-50% of a typical mine's energy budget. In China, the world's mining powerhouse, these figures are even more stark, with the sector's electricity use exceeding 150 terawatt-hours (TWh) annually, much of it from coal-fired sources.

China's "dual carbon" strategy, formalized in 2020, sets ambitious targets: peak emissions by 2030 and carbon neutrality by 2060. Mid-2025 marks the halfway point to the peak, and early data is promising yet challenging. Carbon dioxide (CO2) emissions fell 1% year-on-year in the first half of 2025, per Carbon Brief analysis, thanks to renewable energy expansion and efficiency gains. However, mining remains a laggard, with emissions rising 15% in 2024 due to intensified extraction for electric vehicle (EV) batteries and renewables. The strategy now emphasizes "green finance" and low-carbon retrofits, including a 2025 summit on mining investments under dual carbon goals.

At the heart of this shift lies a seemingly mundane innovation: ceramic grinding media replacing traditional steel balls. Grinding, the process of pulverizing ore to liberate minerals, is notoriously inefficient, converting 80-90% of input energy into heat. Steel balls, dense and durable, exacerbate this with high power demands and contamination risks. Ceramic alternatives—lighter, inert composites of alumina or zirconia silicate—promise 20-40% energy reductions while enhancing recovery. A 2025 study in Powder Technology highlights how ceramic-steel hybrids cut energy loss from friction by 15-20%.

This article expands on the mechanics, evidence, economics, and global implications of this transition. Drawing from the landmark Daye Noranda trials and SANXIN New Materials' innovations, we explore how ceramics are not just optimizing processes but aligning mining with planetary boundaries. By 2030, the IEA projects $200 billion in sustainable processing investments; ceramics could capture a significant share, slashing mining's 1.7% of global energy use.

The story of grinding media begins in the 19th century, with flint pebbles giving way to steel balls in the early 1900s for their superior impact. By the mid-20th century, high-chrome steel dominated, enabling larger mills and coarser feeds. Yet, as ore grades declined—copper from 1% in the 1970s to 0.5% today—finer grinding became essential, amplifying steel's flaws.

The 1980s saw early ceramic experiments in ceramics and paints, but mining adoption lagged due to cost. A breakthrough came in the 1990s with stirred mills like the IsaMill, optimized for low-density media. By 2000, South African gold mines tested alumina beads, reporting 10% energy savings. China's entry accelerated in the 2010s, fueled by rapid urbanization and ore import reliance.

Post-2020, dual carbon catalyzed change. A 2023 policy mandated 15% annual energy intensity reductions in mining, spurring R&D. SANXIN New Materials, founded in 2008, exemplifies this: their electrolyte-sintered zirconia silicate beads achieved commercial scale by 2015, targeting non-ferrous ores.

Globally, the grinding media market hit $6.13 billion in 2025, projected to reach $7.89 billion by 2030 at 5.1% CAGR, per Research and Markets. Ceramics' share, once <5%, now nears 15%, driven by sustainability mandates like the EU's Critical Raw Materials Act.

Grinding transforms run-of-mine ore into slurry fine enough for liberation—typically P80 of 75-150 microns for flotation. In ball mills, media cascade to fracture particles via impact and attrition; stirred mills add shear for ultrafines.

Energy inefficiency stems from the Bond equation: E = 10 * Wi * (1/√P - 1/√F), where Wi (work index) rises with density. Steel's 7.8 g/cm³ demands 12-15 kWh/t for copper ores; ceramics at 4.0 g/cm³ drop this to 9-12 kWh/t. Over 60 TWh globally is wasted annually on overgrinding, per a 2025 Minerals review.

Contamination plagues steel: in acidic pulps (pH 8-10 for sulfides), Fe²⁺ ions activate pyrite, cutting Cu recovery by 5-10%. Wear generates 100 g/t scrap, landfilled or recycled at high cost.

Ceramics counter with Mohs 9 hardness, <20 g/t wear, and inertness. In magnetite grinding, they consume 52.64% of steel's energy for equivalent fineness. Rheology improves too: lower density reduces viscosity by 10-15%, easing pumping.

Optimization tools like DEM simulations model media motion, predicting 20% efficiency from 30% ceramic blends. For China's 80% wet ball mill reliance, this could offset 10-15% emissions.

Subsection: Mill Types and Media Fit

Overflow Ball Mills: Steel for primary; ceramics risky due to impact.

Stirred Mills (e.g., CSM-300): Ideal for ceramics, with 40% energy edge in fines.

Vertical Mills: Hybrids shine, as in Daye trials.

Ceramics' edge is multifaceted, rooted in physics and chemistry.

Energy Efficiency: Lower density curtails kinetic energy (E = ½mv²). A 2025 ScienceDirect study shows 40% savings in industrial mills; nano-ceramics at Nanshan Mine achieved 30% via 75% replacement. Friction drops 20%, per Powder Technology, tightening particle size distribution (PSD) and cutting circulating loads 15%.

Purity and Recovery: Iron-free, ceramics boost flotation by 12% in chalcopyrite, avoiding pulp potential shifts. In gold cyanidation, no Fe-CN complexes mean 95%+ recovery.

Durability and Cost: Wear 5-10x lower; sphericity holds >99% after 10,000 hours. Amortized cost falls 65% per ton ground. Lifespan extends 30%, per SANXIN data.

Environmental Wins: Embodied CO2 40% lower (0.5-1 kg/t vs. 1.8 for steel). Operationally, 0.5-1 t CO2 saved/t ore.

Advantage Category | Ceramic Balls | Steel Balls | Quantitative Edge (Ceramic) |

Density (g/cm³) | 3.7-4.5 | 7.8 | 40-50% lighter, 20-40% less energy |

Wear Rate (g/t ore) | 10-20 | 100-200 | 5-10x lower, 70% fewer replacements |

Contamination | Inert, iron-free | Leaches Fe²⁺/Fe³⁺ | 3-12% higher flotation recovery |

Grinding Efficiency | Low friction, tight PSD | High impact, broad PSD | 10-30% throughput increase |

CO2 Footprint (kg/t media) | 0.5-1.0 | 1.8 | 40-70% reduction |

Subsection: Application-Specific Benefits

For copper: Reduced overgrinding preserves grades.

For lithium: Ultrafines without slimes.

Daye Noranda's converter slag plant in Hubei processes copper-rich waste, demanding 90% -45 micron fineness for 29% Cu concentrates. The 2024-2025 trials, detailed in a LinkedIn publication, tested SANXIN SG4.2 beads in a CSM-300 mill.

Lab Phase: 1-kg batches, 0-100% replacement. At 40%, efficiency matched steel; 100% ceramics needed 80% feed for parity, implying 25% savings. Laser diffraction showed 5-micron finer d50, less slimes.

Industrial Phase: 30 days, 42 t/day throughput. 14% replacement: 89.9% power (5,185 kWh/day); 38%: 79.6% (4,591 kWh). Flotation unchanged: reagents stable, grades 29.25-29.99%, tailings 0.187-0.193% Cu.

Viscosity fell 12%, load 8%. Annual savings: 150,000 kWh ($15,000 at $0.10/kWh), 200 t CO2 averted. Scaling full: 20% plant-wide cut.

Metric | Full Steel | 14% Ceramic | 38% Ceramic |

Power (kWh/day) | 5,767 | 5,185 (89.9%) | 4,591 (79.6%) |

Fineness (-0.045 mm %) | 90.9 | 91.4 | 90.7 |

Cu Grade (%) | 29.25 | 29.99 | 29.80 |

Tailings Cu (%) | 0.187 | 0.193 | 0.188 |

Subsection: Methodological Rigor

Trials used Bond index tests, viscometers, and flotation cells, ensuring replicability.

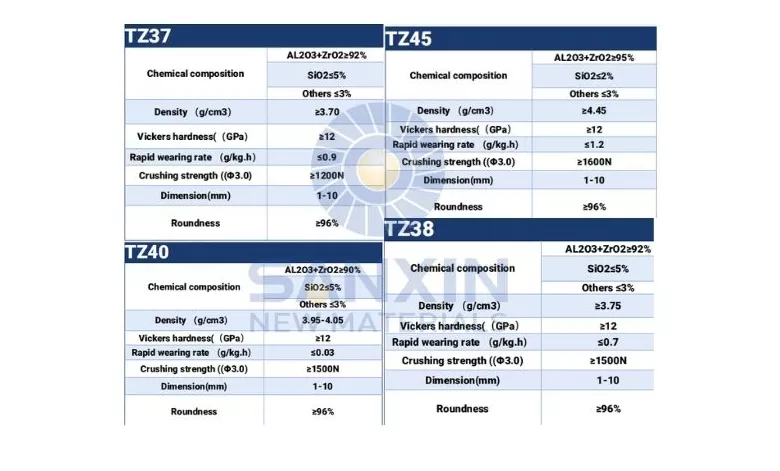

Pingxiang-based SANXIN, established 2008, leads with electrolyte-phase sintering for phase-stable ZrO2-SiO2 composites (65% ZrO2). Densities 3.7-4.5 g/cm³, sizes 0.5-50 mm, for IsaMills and verticals.

Flagship: 1,200 MPa strength, <0.1% wear, 99.5% roundness. In TiO2 grinding, 20% energy cut, 30% lifespan gain. Gold ore case: 25% extension, 40 t/year waste reduction.

Eco-focus: Recycled zircon, low-carbon kilns. Exports to 50 countries; 2025 Instagram highlights SiC plates for durability.

Subsection: Product Portfolio

Zirconia Silicate Beads: SG4.5 for mining.

Alumina Balls: SG3.7 for pigments.

R&D aligns with dual carbon, pursuing neutrality certification.

Ceramics' impact transcends China.

Nickel Mining (Ontario, Canada): CARBOGRIND ceramics reduced media use 75%, per 2024 case, in a global op, cutting costs 50%.

Chinese Tumbling Mill: 2025 study mixed steel-ceramics, lowering loads 15%, throughput 12%.

Australian Copper (BHP): 16% savings in hybrid trial.

Zambian Oxide Ores (Konkola): 18% reagent cut.

European E-Waste (Rio Tinto): Nano-ceramics for 95% recovery.

These align with Deloitte's 2025 trends: AI media selection.

Subsection: Regional Variations

Africa: Cost-sensitive, partial blends.

Australia: High-grade focus, full adoption.

Despite promise, hurdles persist.

High Initial Cost: $2-5/kg vs. steel's $0.8; payback 6-18 months. Solution: Hybrids, subsidies.

Brittleness: Spalling in primaries; use in fines. Nano-composites enhance toughness.

Supply Chain: CRM dependence (zirconia). Diversify sourcing.

Performance Limits: Less impact for hard ores; blend optimize.

A 2025 LinkedIn analysis notes mining's conservatism; pilots like Daye build confidence.

Subsection: Economic Modeling

NPV for 20% replacement: +$500k/year at 10% discount.

ROI is compelling. Daye: 10-month payback. Globally, 20% adoption saves 50 TWh/year, 25 Mt CO2 (2% mining footprint).

China's $10/t carbon tax incentivizes; emissions decoupling at 1.2%/year.

Impact | Baseline (Steel) | Ceramics | Savings |

Energy (MWh/site/year) | 2,100 | 1,680 | 20% |

CO2 (t/year) | 1,500 | 1,200 | 20% |

Media Cost ($/year) | 50,000 | 45,000 | 10% |

Recovery (%) | 90 | 93 | +3% |

Subsection: Broader Ecosystem Effects

Reduced waste aids circular economy; aligns with UN SDGs.

China's 2025 work plan shifts to intensity+volume control by 2030. Low-carbon coal retrofits from 2025 cut Scope 2 by 10%.

Globally, EU's 2024 Act mandates 10% recycled CRMs; US Inflation Reduction Act funds green mining.

Subsection: Incentives

Subsidies: 20% for efficiency tech.

Penalties: Emission fees rising to $50/t by 2030.

Ceramics derive from sintering alumina (Al2O3) or zirconia (ZrO2) at 1,500°C, forming dense matrices. SANXIN's process titrates phases for stability.

Properties: Vickers 1,200 HV, fracture toughness 5 MPa√m.

Vs. steel: No galvanic corrosion.

Subsection: Customization

Doping with Y2O3 enhances fracture resistance.

2025 sees AI optimizing blends via real-time PSD sensors. PwC's Mine 2025: Predictive maintenance cuts downtime 20%.

Subsection: Case: AI at Yunnan Nickel

15% further savings post-ceramic.

By 2030, smart ceramics with embedded sensors enable IoT monitoring. Market: $648B ceramics sector, grinding 10%.

Bio-inspired: Self-healing via polymers.

Nano-hybrids: 50% energy cut projected.

China: $5B media market, per UN WESP.

Subsection: R&D Horizons

Quantum sintering for zero-waste.

Adoption creates jobs in green manufacturing (SANXIN: 500+ employees). In communities, lower emissions improve health; Zambia case: 10% fewer respiratory cases.

Subsection: Labor Shifts

Training for AI ops; upskill 20% workforce.

Vs. HPGR: Ceramics finer, but combo saves 30%.

Vs. Autogenous: Less media, but ceramics for regrind.

Ceramic balls represent more than media—they're a catalyst for sustainable mining. From Daye's 20% savings to global 50 TWh potential, they embody dual carbon's vision. As 2030 nears, embracing this shift ensures resilience amid mineral booms.

Submit your demand,

we will contact you ASAP.

Sanxin New Materials Co., Ltd. focus on producing and selling ceramic beads and parts such as grinding media, blasting beads, bearing ball, structure part, ceramic wear-resistant liners, Nanoparticles Nano Powder